Many middle-aged adults are finding themselves caught between supporting their dependent children while looking after their aging parents.

Many middle-aged adults are finding themselves caught between supporting their dependent children while looking after their aging parents.

This predicament places those in their 40s and 50s in a particularly difficult position from both a financial and emotional standpoint. So how can those in the Sandwich Generation survive without getting eaten alive? By planning.

One such way to plan for the anticipated needs of your aging parents is to purchase a long-term care insurance policy for them. This type of policy allows for quality care for your parents while helping to relieve the financial and caregiving burdens from you and your family. Be aware, long-term care insurance is medically underwritten so your parents will have to take a physical and share their medical records during the underwriting process.

Plus, if you’re in your 40s or 50s and healthy, it’s also a great time to consider purchasing a policy for yourself while premiums are more affordable.

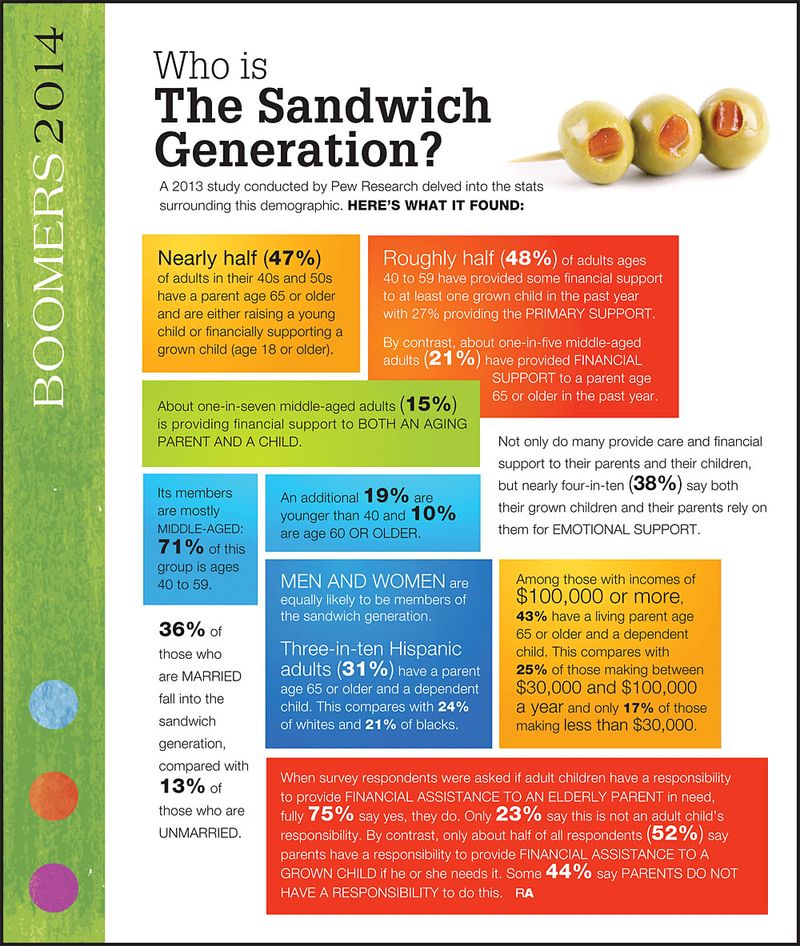

Take a look at this infographic from LifeHealthPro using statistics from a study conducted by Pew Research. As you can see, the need is real and you need to be prepared for the consequences.

Source: Life Happens, 2014.